Varianse 5 Star + Review

To be up front from the start, we hadn’t come across Varianse before being introduced to some of their promotional social-media posts related to its cTrader platform. As we are always on the lookout for a challenger to some of the bigger online brokers out there, we jumped at the chance to do a broker review of a Varianse’s live account. For six months we put this broker to the test, and guess what, we can’t recommend the broker highly enough after doing so. We would have given Varianse more than a five star broker if it were possible. The bottom line is Varianse gives you the equivalent services that clients of a private bank or major investment bank receive. Below is an in depth list of the reasons why we rate Varianse so highly in our broker review and why you should really consider opening an online account today.

Top Customer Service

The customer service staff at Varianse actually want you to succeed as a trader. Its highly trained and experienced team members are even called “Client Success Managers” – a name that truly shines through in terms of the support they offer. Staff were knowledgeable beyond just their own services. They were also well informed about trading, technology and financial markets more generally. We suspect that much of the client success staff had prior experience trading either for themselves or at bigger institutions. This certainly would chime with the information on their website, which cites their long held experience.

Above all, the customer service team made themselves readily available either by phone, electronic chat, or email 24/7. Such one-on-one support is so refreshing in today’s modern online world where such interaction is typically rare. Sometimes you just want to pick up the phone and get an answer. Varianse does just that. In fact, we would say services levels are equivalent to the type of support level institutions and big private clients get at major investment banks. Tj, the Head of Client Success was particularly attentive in terms of answering our direct questions on different account types and training us up on the cTrader platform.

The Right Business Model

We suspect the customer service team is helpful, honest, and transparent because Varianse operates a purely execution only model. It only passes your trades on to the market to make trades. In contrast to market making firms or those who run a mixed model, by taking the other side of your trade, which means they are effectively betting against you. Therefore, when you trade with Varianse, there is zero conflict between yourself or the broker. When you trade with Varianse you don’t need to worry about stop hunting, purposeful pricing feed manipulation, or any other unscrupulous broker activity. Varianse does not profit from any of those activities. It only makes money from the spread and commission it collects from executing your trade.

Traders are also afforded added protections by adopting its cTrader platform. Unlike other proprietary platforms or MT4, The cTrader platform does not let brokers manipulate trading history or open positions. Because cTrader is hosted by Spotware, brokers don’t have the access to modify data in the database. Fraud brokers are known to do this to make their clients lose. MT4, for example, is designed in a way that is quite easy for brokers. Obviously regulated brokers, like Varianse wouldn’t do this anyway since they are audited and they will get caught out, but the firm’s adoption of the cTrader platform does attest to the willingness to be transparent.

Your Funds Are Safe

Let’s be honest, you don’t want to be handing your hard earned money over to any disreputable company. Which brings us to the next point, Varianse is genuinely regulated. By the way, the firm is not just regulated in a single jurisdiction but three. They include the Financial Conduct Authority (FCA) in the United Kingdom, the Financial Services Commission (FSC) in Mauritius, and the Labuan Financial Services Authority in Malaysia. In other words, there can be no real funny business from Varianse with your funds. Which regulator you go with, however, does make a difference in terms of the amount of leverage you can utilize when you trade. The FSC regulated accounts get you substantially more in terms of leverage.

If Varianse’s strong regulated position doesn’t give you the necessary level of security you require, the firm goes one extra level by using segregated accounts to store client money. This means that they don’t mix up client money with their own company money. We had zero problems either depositing or withdrawing from Varianse. Its banking partnership with Barclays, a tier-1 global bank, adds an additional layer of security that gives us maximum comfort that our funds are safe and secure.

Easy Account Selection

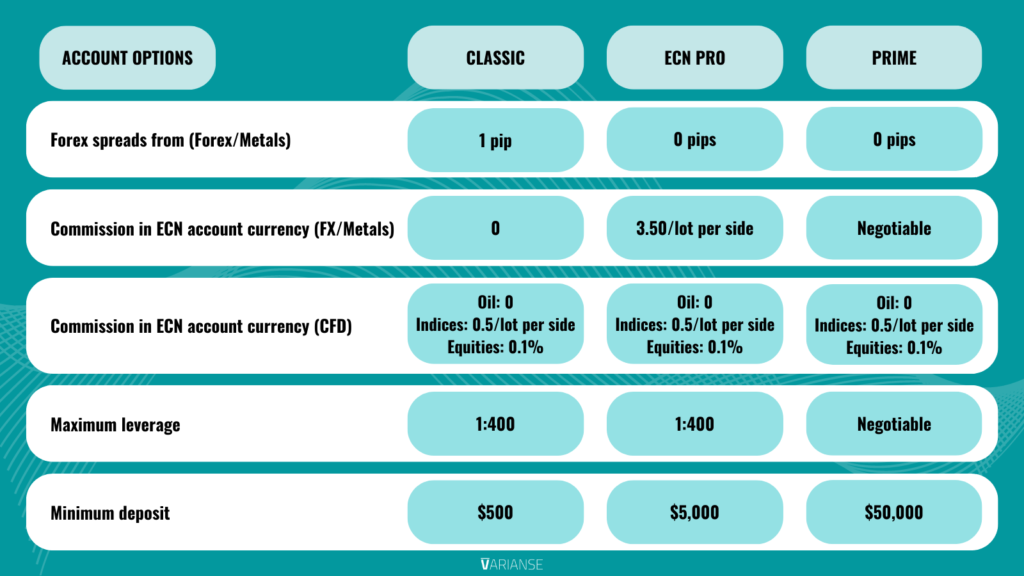

Out of the many brokers we’ve used, Varianse arguably makes account selection the easiest. Three account types are available: the Classic, ECNpro, and Prime Accounts with minimum deposit sizes of $500, $5,000, and $50,000, respectively. Each individual account type really matches the type of traders out there with the classic account charging an all in spread rather than commission for the brokerage service. The other two account types are more suited for more professional type traders. Some of their advantages include level-2 fill depth of market pricing, and FIX API access (in case you want to build your own interface). If you are going for the top Prime package you are getting liquidity optimisation and big ticket layering to your trades, plus your own sponsored cross-connected VPS if you choose.

We chose the ECNpro type because it pretty much met our needs. Still, we didn’t want to commit a full $5,000 to test out the live account. Hey, this was the first time using Varianse, so we didn’t want to make that upfront commitment. Thankfully, TJ on the Client Services team understood that and was happy for us to start using the ECNpro account with just a $3,000 deposit. Varianse, in other words, is very much willing to be flexible in terms of their different account types. Plus, thanks to the promotional offer from one of their social media posts, we were able to get $2/lot cash back on our trades. The link to that promotion can be found here and at the time of writing was still valid.

Outstanding cTrader Platform

Your money could be safe, the customer service may be outstanding, and the account types might look good on paper. But if the platform doesn’t perform, then what’s the point. We are pleased to say that the Varianse cTrader platform really impressed us on two levels. First, the best in class trade execution Varianse as a broker provides across four different asset classes: forex, commodities, indices, and individual equities. Second, the incredible bells and whistles the cTrader platform offers in comparison to more basic proprietary broker platforms and other more general used platforms like MT4.

The investment Varianse has made into its backend is clear. Our orders were executed at lightning speed, we never had a case where our orders were never filled, and any slippage we experienced was always positive. Varianse, as an execution-order only broker, taps you into a deep pool of liquidity from big banks, investment funds, etc. straight from ECN networks. In turn, spreads are consistently tight with Varianse. In summary, whether you are a swing trader or scalper, or heavy algo user the Varianse platform setup will exceed whatever you need in terms of execution.

Platform wise, cTrader takes the day to day trading experience to the next level. Most advanced functionality comes standard with cTrader, including the ability to set multiple take profits in order to scale out of your trades, real performance stats straight to the platform. Trading algos also perform faster on the cTrader platform. For us, however, what really sold us was the ease of user interface, which means even a novice trader can easily get to grips with using cTrader, while a pro trader will find the deeper extra functionality.

Copy Trade

Varianse cTrader users have the added ability to both copy trade and/or become a copy trade strategy provider. This provides an immense advantage over other brokers who don’t provide such functionality. Maybe you are struggling to come up with trade ideas or just don’t have the time to devote to covering markets for a bit. Don’t stress, the Varianse cTrader platform has hundreds of strategies with verified performance records for you to copy Whether you at home or on the go the desktop, web, or mobile applications allow you to immediately invest and divest at your leisure.

On the other hand, if you are a professional manual or algorithmic trader, you can set yourself up on the platform with minimal hassle. Access over $20bn capital and 2 million of investable assets. You have the ability to charge your investors management, performance, and volume fees just like a hedge fund. All of the copy management of investors is done straight from the platform and paid out to you in cash through your Varianse account. Maybe you are considering spreading your potential investor net wider, the cTrader platform automatically generates investor links and supports affiliate marketing schemes.

Overall Conclusion

We really put this broker to the test over a six month period and it delivered where it counts. From its incredible customer service to the strength of its platform, Varianse is definitely more than a five star broker. Equally, the firm is also regulated and your funds are genuinely held safely in secured accounts. If you are looking for a more personalized brokerage experience that offers more competitive spreads than the big boys, we can’t recommend Varianse enough.

Author

Peter Duggan is a professional full-time trader focused on forex and commodities with over 10 years experience. Prior to starting up his own proprietary trading firm, Peter was both forex spot and options traders at several global macro hedge funds in London. He holds an undergraduate degree in Economics from Exeter University and a Masters degree in Quantitative Finance from Manchester University.

Varianse Broker Review

-

Varianse Broker Review

Summary

Varianse is one of the best online brokers we’ve ever reviewed. If you are looking for an online broker that gives you the service level of a private or tier-1 investment bank, Varianse is your number 1 choice. It’s varied account types, tight spreads, and incredible cTrader platform is suitable for both beginner and experienced traders.